Pitroda is demanding a 50 per cent inheritance tax. This means half of anything a person builds will be charged as a tax after their death, and their inheritors will only be able to acquire the remaining 50 per cent.

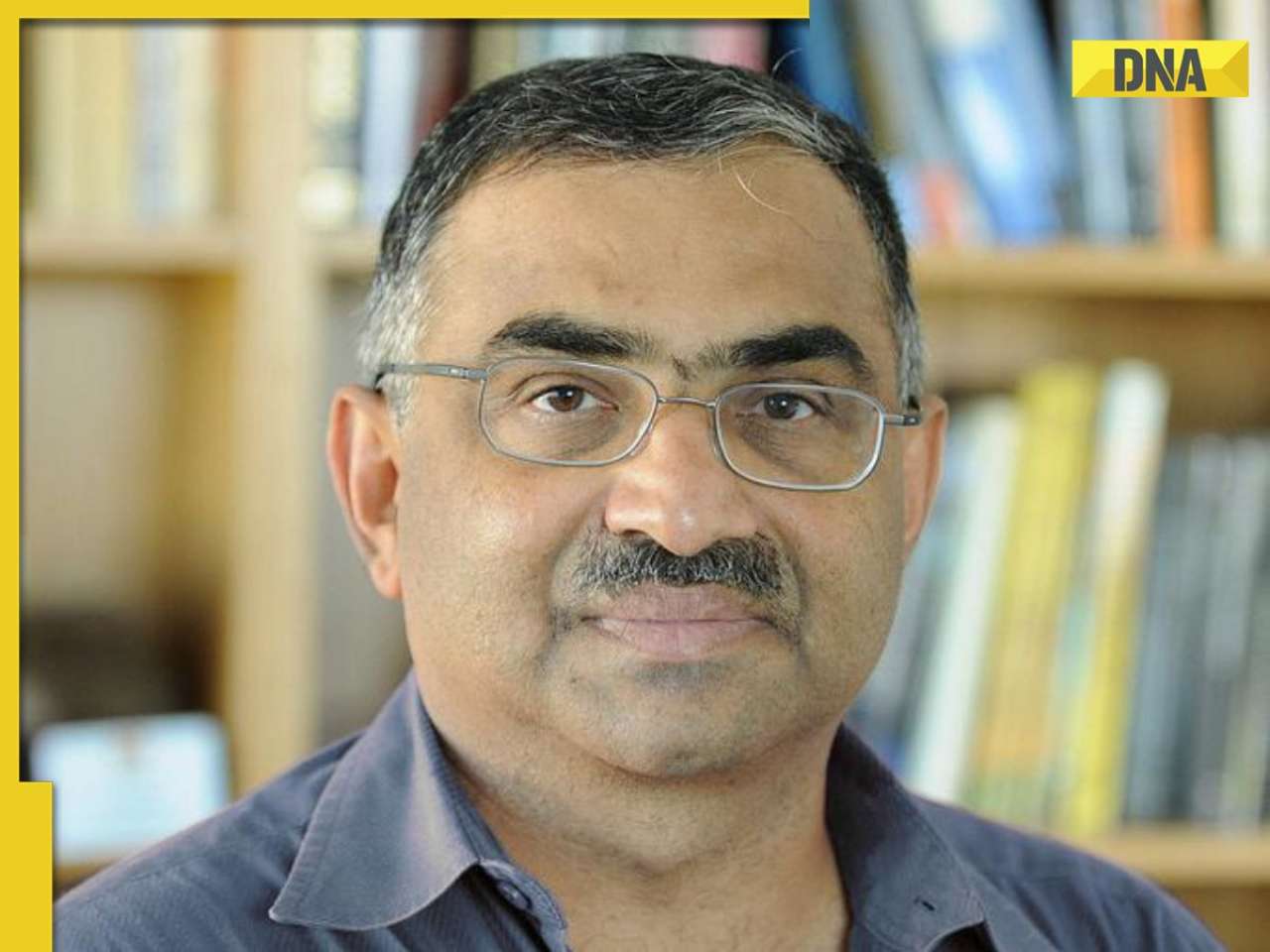

A political row has erupted around wealth redistribution after Sam Pitroda, chairman of the Indian Overseas Congress, urged for an inheritance tax system in India, a system like an existing tax system in the U.S.

Pitroda is demanding a 50 per cent inheritance tax. This means half of whatever a person establishes or creates will be charged as a tax after their death, and their inheritors will only be able to acquire the remaining 50 per cent.

Inheritance Tax in the U.S.

In the United States, an existing inheritance tax is a state tax levied on money or property you inherit from a deceased person's estate. The inheritance tax, as contrary to the federal estate tax, is fulfilled by the beneficiary.

In 2021, only six states in the US implemented an inheritance tax: Lowa, Kentucky, Maryland, Nebraska, New Jersey, and Pennsylvania. The tax rates and exemptions differ by state, with some states excluding some classes of heirs or implementing lower tax rates on transfers to close family members.

Inheritance tax rates can vary from less than 1% to 20% of the inherited property and cash worth. However, the tax is calculated on the amount of a property or money which is over a certain threshold.

While speaking to ANI, Pitroda said, "In America, there is an inheritance tax. If one has $100 million worth of wealth when he dies, he can only transfer probably 45 per cent to his children and the remaining 55 per cent is grabbed by the government. That's an interesting law.”

Inheritance Tax in India

About 40 years ago, a similar taxation system was present in India, but was later nullified by the then Prime Minister Rajiv Gandhi in 1985, in a bid to simplify the tax system and boost investment and savings.

Also called estate duty, the tax was implemented in India in 1953. The tax was levied on transferring assets from a dead person to their heirs. The tax was levied on the total value of the estate of the deceased person, and the inheritors were required to pay some percentage of this amount as tax to the government.

Later, there has been rising demand to reintroduce the tax, particularly due to growing income inequality and the concentration of wealth among rich. However, no relevant step has been introduced for this.

![submenu-img]() PAK vs USA, T20 World Cup 2024: United States beat Pakistan in historic triumph after thrilling super over

PAK vs USA, T20 World Cup 2024: United States beat Pakistan in historic triumph after thrilling super over![submenu-img]() Eid Al Adha 2024: Dhul Hijjah Moon spotted in Saudi Arabia, Dubai, will be celebrated in India on...

Eid Al Adha 2024: Dhul Hijjah Moon spotted in Saudi Arabia, Dubai, will be celebrated in India on...![submenu-img]() DNA TV Show: What is NEET-UG 2024 results controversy? Know full story here

DNA TV Show: What is NEET-UG 2024 results controversy? Know full story here![submenu-img]() Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'

Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'![submenu-img]() BJP calls Rahul Gandhi's claims of 'biggest stock market scam' against PM Modi, Amit Shah 'baseless'

BJP calls Rahul Gandhi's claims of 'biggest stock market scam' against PM Modi, Amit Shah 'baseless'![submenu-img]() NEET exam 2024: Students demand re-exam after 67 students score...

NEET exam 2024: Students demand re-exam after 67 students score...![submenu-img]() Meet IIT-JEE topper, scored 100 percentile in JEE Mains 2024, she is now planning to join...

Meet IIT-JEE topper, scored 100 percentile in JEE Mains 2024, she is now planning to join...![submenu-img]() NEET UG topper 2024: Meet boy who topped MBBS exam by securing 720 out of 720, he is Alakh Pandey's...

NEET UG topper 2024: Meet boy who topped MBBS exam by securing 720 out of 720, he is Alakh Pandey's...![submenu-img]() Meet IIT graduate, Indian genius who made key space discoveries, he is Narayana Murthy’s…

Meet IIT graduate, Indian genius who made key space discoveries, he is Narayana Murthy’s…![submenu-img]() Meet man whose first salary was Rs 5000, turned down Rs 75 crore job offer, built Rs 8000 cr firm, is India's richest...

Meet man whose first salary was Rs 5000, turned down Rs 75 crore job offer, built Rs 8000 cr firm, is India's richest...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() Lok Sabha Elections 2024: 6 states with highest number of seats

Lok Sabha Elections 2024: 6 states with highest number of seats![submenu-img]() Lok Sabha Election Results 2024: Key candidates to watch out for in South India

Lok Sabha Election Results 2024: Key candidates to watch out for in South India![submenu-img]() Lok Sabha Elections 2024: Key seats Exit Poll predictions

Lok Sabha Elections 2024: Key seats Exit Poll predictions![submenu-img]() Lok Sabha Elections 2024: Key battles in Hindi heartland

Lok Sabha Elections 2024: Key battles in Hindi heartland![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'

Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'![submenu-img]() Nana Patekar was asked to leave this Madhuri Dixit film, director replaced him with Paresh Rawal because...

Nana Patekar was asked to leave this Madhuri Dixit film, director replaced him with Paresh Rawal because...![submenu-img]() Watch: Sanjana Sanghi joins forces with Dia Mirza, addresses global warming, climate change on World Environment Day

Watch: Sanjana Sanghi joins forces with Dia Mirza, addresses global warming, climate change on World Environment Day![submenu-img]() Meet actress who was to be a superstar, gave many hit films, got married, was banned from industry due to..

Meet actress who was to be a superstar, gave many hit films, got married, was banned from industry due to..![submenu-img]() 'I'm going to bring...': Anil Kapoor reacts to replacing Salman Khan as host of Bigg Boss OTT 3, show will stream from..

'I'm going to bring...': Anil Kapoor reacts to replacing Salman Khan as host of Bigg Boss OTT 3, show will stream from..![submenu-img]() Meet world's most wanted woman, mastermind of Rs 36000 crore fraud, her crime is...

Meet world's most wanted woman, mastermind of Rs 36000 crore fraud, her crime is...![submenu-img]() Viral video: Influencer makes security guard's dream trip to Ayodhya Ram Mandir a reality, watch

Viral video: Influencer makes security guard's dream trip to Ayodhya Ram Mandir a reality, watch![submenu-img]() 74-year-old woman found alive at funeral home after being pronounced dead

74-year-old woman found alive at funeral home after being pronounced dead![submenu-img]() This country with 96% Muslim population has banned Hijab, beard, prohibition on religious books too

This country with 96% Muslim population has banned Hijab, beard, prohibition on religious books too![submenu-img]() Viral video: Train passes through burning forest amid Russia's wildfires, watch

Viral video: Train passes through burning forest amid Russia's wildfires, watch

)

)

)

)

)

)

)