In 2023, India was ranked as the fastest-growing automobile market among the world’s 10 largest markets, compared to 2019. According to the Reserve Bank of India’s data, vehicle loan growth has surpassed home loan growth for the past four years, with consumers prioritising cars and SUVs over homes.

This increase in finance penetration for passenger vehicles between 2019 and 2023 indicates that consumers now prefer owning a car, making it a necessity in Indian households.

When you own a car, you can enjoy the convenience and freedom to travel wherever you’d like to go. However, a new car also comes with certain responsibilities and obligations; you must ensure the vehicle is adequately insured. This requires you to have a nuanced understanding of car insurance. Fortunately, motor insurance offered through Bajaj Finance Insurance Mall makes the process of buying car insurance simple and convenient.

Importance of car insurance

According to the Motor Vehicles Act 1988, has made it mandatory for every vehicle owner in India to have a valid third-party car insurance policy that shields you financially from the claims of other parties involved in the accident. Your insurance policy also acts as an important safety net, providing financial protection from accidents, theft, and natural disasters

Purchasing car insurance plans can be simple and stress-free, as you can buy one with zero paperwork through Bajaj Finance Insurance Mall. Before browsing and comparing plans, it is vital that you know the different types of car insurance and their significance.

Types of car insurance

- Third-party liability insurance: As per the Motor Vehicles Act, this is the most basic type of car insurance and is compulsory for all vehicles—even parked or unused cars. A third-party liability covers the damages incurred by the third party in the event of an accident.

- Comprehensive insurance: If you want an insurance policy that provides extensive coverage by offering third-party liability and covers damage to the insured vehicle, you must choose a comprehensive insurance plan.

- Own damage insurance: Unlike third-party liability insurance, an own damage insurance plan covers damages to the insured vehicle. However, it does not include third-party liabilities. Thus, it is ideal for those who already have a third-party liability policy.

Selecting the right car insurance

It is important to choose a car insurance policy wisely, and this can be quite difficult, given the vast array of options in the market. On the Bajaj Finance Insurance Mall, you can compare various car insurance plans from reputed insurers; you can consider premiums, coverage, and add-on benefits while making the comparison.

Important factors to consider

- Coverage: First and foremost, you must ensure the policy provides comprehensive coverage. This includes own damage, third-party liability, and add-ons like roadside assistance cover and no claim bonus (NCB) protector.

- Premium: The policy premium differs from one insurer to another. A lower premium may seem attractive, but it shouldn’t come at the cost of essential coverage.

- Claim settlement ratio: Another important factor to consider is the claim settlement ratio. You must select an insurer with a high claim settlement ratio, as this indicates their reliability and efficiency in processing claims.

Financing your car: New and used car loans

Buying a car—whether new or used—is a major financial decision. Today, you can easily afford expensive cars through car loan, as these provide the necessary financial support. Car loans allow you to spread the cost over several months and make payments in monthly instalments. Bajaj Finance offers two types of car loans – new car finance for funding a new car purchase, used car loans to fund the purchase of a pre-owned vehicle.

New car financing

While buying a new car is an important milestone, its hefty price tag can deter you from making the purchase. However, with the Bajaj Finserv New Car Finance, you can enjoy car loans with highly competitive interest rates and flexible repayment options.

Important features

- Multiple variants: Depending on your requirements and preferences, you can choose from Flexi Term, Flexi Hybrid, or Term Loans.

- High loan amount: You can secure a loan amount of up to Rs. 10 crore, covering up to 100% of the car’s on-road price.

- Flexible tenure: Tenures between 12 and 96 months further simplify the repayment process.

- Quick processing: Thanks to minimal documentation requirements and quick approval times, you can enjoy quick and hassle-free loan processing.

Used car financing

If you are a first-time buyer, choosing a second-hand car can work in your favour. Purchasing a used car comes with several benefits, including lower insurance costs, comparatively lower prices, and reduced registration fees.

Important features

- Unique variants: You can choose from three loan variants: Term, Flexi Hybrid, and Flexi Term loans. This lets you select the loan variant that best caters to your needs.

- High-value finance: You can avail of a loan amount of up to Rs. 77 lakh and bring home your dream car with ease..

- Flexible repayment: The loan repayment period ranges from 12 to 72 months, which eases the repayment burden.

- Quick processing: Once your loan application is approved, the loan amount will be credited to your account within 48 hours* (*terms and conditions apply).

Conclusion

Securing your ride in India involves selecting a car insurance policy for a worry-free driving experience. A comprehensive insurance plan offers financial protection covering both the damages incurred by third party as well as own damage. . Similarly, a favourable loan provides you with the financial backing you need to own your dream car. The Bajaj Finance Insurance Mall is your one-stop solution for your insurance needs, providing a range of options tailored to your requirements. On the other hand, with the Bajaj Finserv New Car Finance or Bajaj Finserv Used Car Loan, you can bring home your desired model and pay for it in easy, manageable monthly instalments.

Disclaimer: T&C Apply. Bajaj Finance Limited (‘BFL’) is a registered corporate agent of third party insurance products of Bajaj Allianz Life Insurance Company Limited, HDFC Life Insurance Company Limited, Future Generali Life Insurance Company Limited, Bajaj Allianz General Insurance Company Limited, SBI General Insurance Company Limited, ACKO General Insurance Limited, ICICI Lombard General Insurance Company Limited, HDFC ERGO General Insurance Company Limited, Tata AIG General Insurance Company Limited, The New India Assurance Company Limited, Cholamandalum MS General Insurance Company Limited, Niva Bupa Health Insurance Company Limited , Aditya Birla Health Insurance Company Limited, Manipal Cigna Health Insurance Company Limited and Care Health Insurance Company Limited under the IRDAI composite CA registration number CA0101. Please note that, BFL does not underwrite the risk or act as an insurer. Your purchase of an insurance product is purely on a voluntary basis after your exercise of an independent due diligence on the suitability, viability of any insurance product. Any decision to purchase insurance product is solely at your own risk and responsibility and BFL shall not be liable for any loss or damage that any person may suffer, whether directly or indirectly. Please refer insurer's website for Policy Wordings. For more details on risk factors, terms and conditions and exclusions please read the product sales brochure, policy wording carefully before concluding a sale. Tax benefits applicable if any, will be as per the prevailing tax laws. Tax laws are subject to change. BFL does NOT provide Tax/Investment advisory services. Please consult your advisors before proceeding to purchase an insurance product. URN No. BFL/Advt./23-24/354

(This article is part of IndiaDotCom Pvt Ltd’s Consumer Connect Initiative, a paid publication programme. IDPL claims no editorial involvement and assumes no responsibility, liability or claims for any errors or omissions in the content of the article. The IDPL Editorial team is not responsible for this content.)

![submenu-img]() PAK vs USA, T20 World Cup 2024: United States beat Pakistan in historic triumph after thrilling super over

PAK vs USA, T20 World Cup 2024: United States beat Pakistan in historic triumph after thrilling super over![submenu-img]() Eid Al Adha 2024: Dhul Hijjah Moon spotted in Saudi Arabia, Dubai, will be celebrated in India on...

Eid Al Adha 2024: Dhul Hijjah Moon spotted in Saudi Arabia, Dubai, will be celebrated in India on...![submenu-img]() DNA TV Show: What is NEET-UG 2024 results controversy? Know full story here

DNA TV Show: What is NEET-UG 2024 results controversy? Know full story here![submenu-img]() Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'

Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'![submenu-img]() BJP calls Rahul Gandhi's claims of 'biggest stock market scam' against PM Modi, Amit Shah 'baseless'

BJP calls Rahul Gandhi's claims of 'biggest stock market scam' against PM Modi, Amit Shah 'baseless'![submenu-img]() NEET exam 2024: Students demand re-exam after 67 students score...

NEET exam 2024: Students demand re-exam after 67 students score...![submenu-img]() Meet IIT-JEE topper, scored 100 percentile in JEE Mains 2024, she is now planning to join...

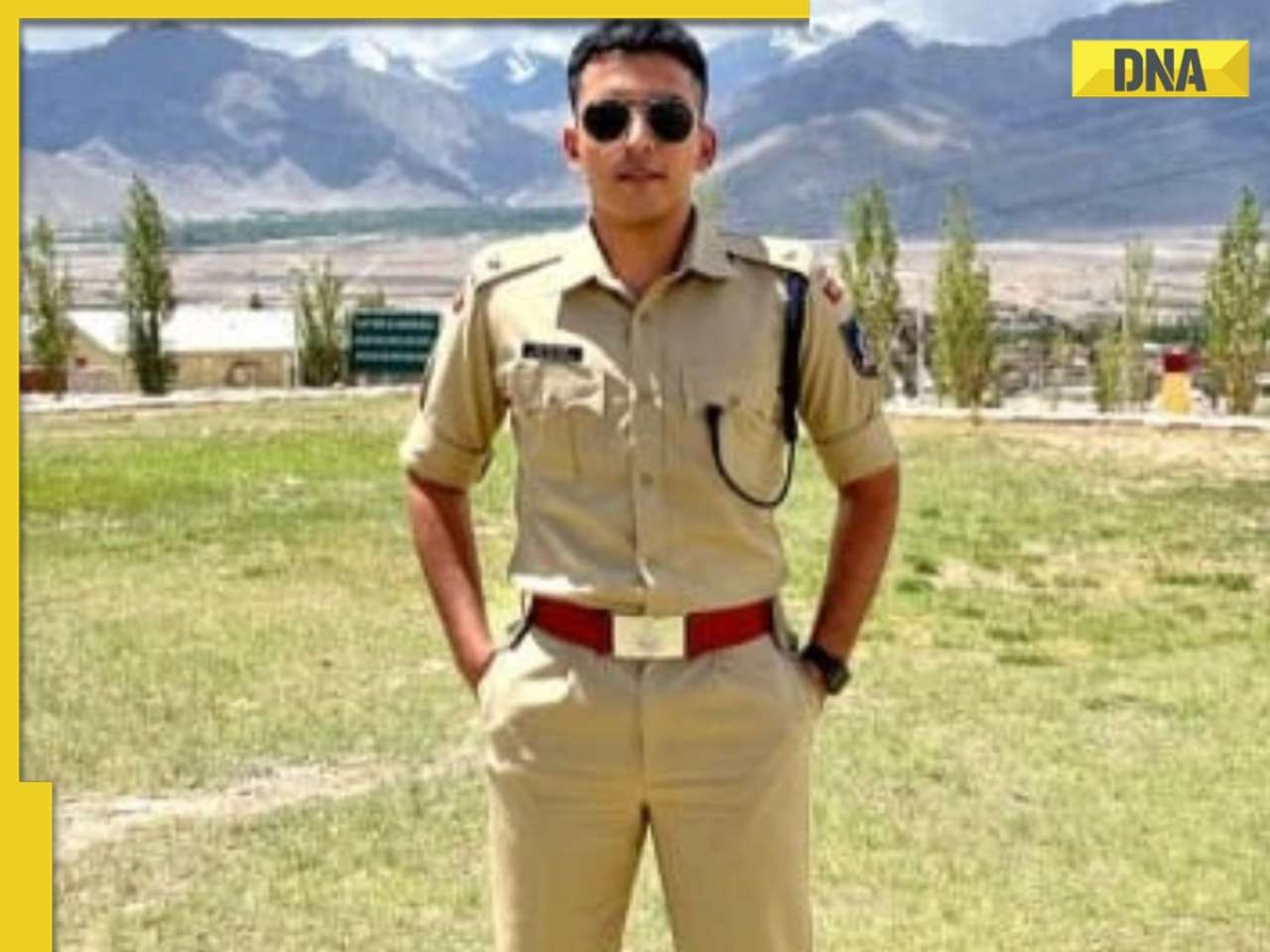

Meet IIT-JEE topper, scored 100 percentile in JEE Mains 2024, she is now planning to join...![submenu-img]() NEET UG topper 2024: Meet boy who topped MBBS exam by securing 720 out of 720, he is Alakh Pandey's...

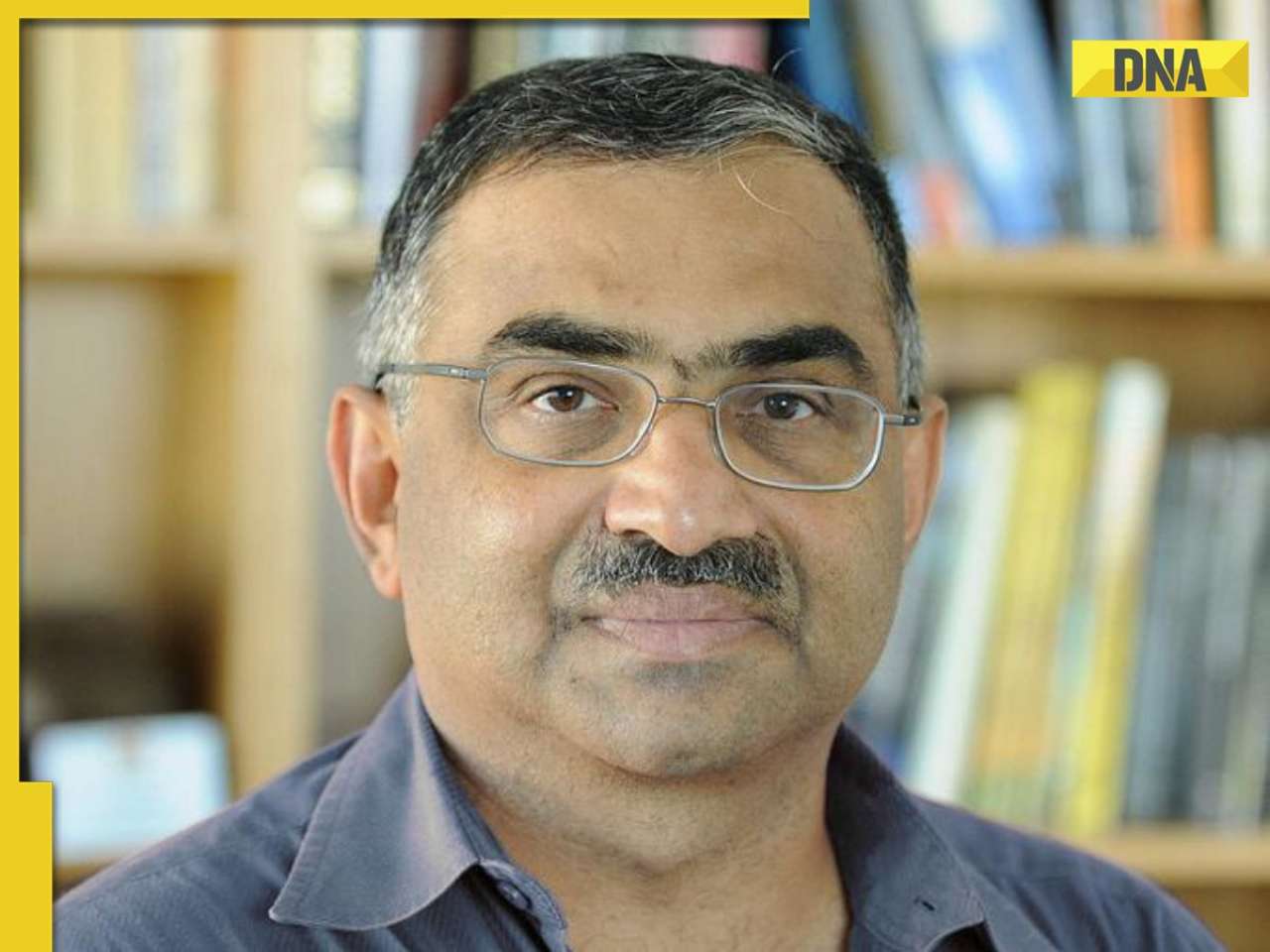

NEET UG topper 2024: Meet boy who topped MBBS exam by securing 720 out of 720, he is Alakh Pandey's...![submenu-img]() Meet IIT graduate, Indian genius who made key space discoveries, he is Narayana Murthy’s…

Meet IIT graduate, Indian genius who made key space discoveries, he is Narayana Murthy’s…![submenu-img]() Meet man whose first salary was Rs 5000, turned down Rs 75 crore job offer, built Rs 8000 cr firm, is India's richest...

Meet man whose first salary was Rs 5000, turned down Rs 75 crore job offer, built Rs 8000 cr firm, is India's richest...![submenu-img]() DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo

DNA Verified: Did Kangana Ranaut party with gangster Abu Salem? Actress reveals who's with her in viral photo![submenu-img]() DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here

DNA Verified: New Delhi Railway Station to be closed for 4 years? Know the truth here![submenu-img]() DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here

DNA Verified: Did RSS chief Mohan Bhagwat praise Congress during Lok Sabha Elections 2024? Know the truth here![submenu-img]() DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'

DNA Verified: Is CAA an anti-Muslim law? Centre terms news report as 'misleading'![submenu-img]() DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message

DNA Verified: Lok Sabha Elections 2024 to be held on April 19? Know truth behind viral message![submenu-img]() Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats

Lok Sabha Elections 2024 Result: From Smriti Irani to Mehbooba Mufti, these politicians are trailing in their seats![submenu-img]() Lok Sabha Elections 2024: 6 states with highest number of seats

Lok Sabha Elections 2024: 6 states with highest number of seats![submenu-img]() Lok Sabha Election Results 2024: Key candidates to watch out for in South India

Lok Sabha Election Results 2024: Key candidates to watch out for in South India![submenu-img]() Lok Sabha Elections 2024: Key seats Exit Poll predictions

Lok Sabha Elections 2024: Key seats Exit Poll predictions![submenu-img]() Lok Sabha Elections 2024: Key battles in Hindi heartland

Lok Sabha Elections 2024: Key battles in Hindi heartland![submenu-img]() Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?

Lok Sabha Elections 2024: What are exit polls? When and how are they conducted?![submenu-img]() DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?

DNA Explainer: Why was Iranian president Ebrahim Raisi seen as possible successor to Ayatollah Khamenei?![submenu-img]() DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?

DNA Explainer: Why did deceased Iranian President Ebrahim Raisi wear black turban?![submenu-img]() Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?

Iran President Ebrahim Raisi's death: Will it impact gold, oil prices and stock markets?![submenu-img]() Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?

Haryana Political Crisis: Will 3 independent MLAs support withdrawal impact the present Nayab Saini led-BJP government?![submenu-img]() Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'

Anusha Dandekar says Jason Shah's claims about their failed relationship are lies: 'Everyone wants to use...'![submenu-img]() Nana Patekar was asked to leave this Madhuri Dixit film, director replaced him with Paresh Rawal because...

Nana Patekar was asked to leave this Madhuri Dixit film, director replaced him with Paresh Rawal because...![submenu-img]() Watch: Sanjana Sanghi joins forces with Dia Mirza, addresses global warming, climate change on World Environment Day

Watch: Sanjana Sanghi joins forces with Dia Mirza, addresses global warming, climate change on World Environment Day![submenu-img]() Meet actress who was to be a superstar, gave many hit films, got married, was banned from industry due to..

Meet actress who was to be a superstar, gave many hit films, got married, was banned from industry due to..![submenu-img]() 'I'm going to bring...': Anil Kapoor reacts to replacing Salman Khan as host of Bigg Boss OTT 3, show will stream from..

'I'm going to bring...': Anil Kapoor reacts to replacing Salman Khan as host of Bigg Boss OTT 3, show will stream from..![submenu-img]() Meet world's most wanted woman, mastermind of Rs 36000 crore fraud, her crime is...

Meet world's most wanted woman, mastermind of Rs 36000 crore fraud, her crime is...![submenu-img]() Viral video: Influencer makes security guard's dream trip to Ayodhya Ram Mandir a reality, watch

Viral video: Influencer makes security guard's dream trip to Ayodhya Ram Mandir a reality, watch![submenu-img]() 74-year-old woman found alive at funeral home after being pronounced dead

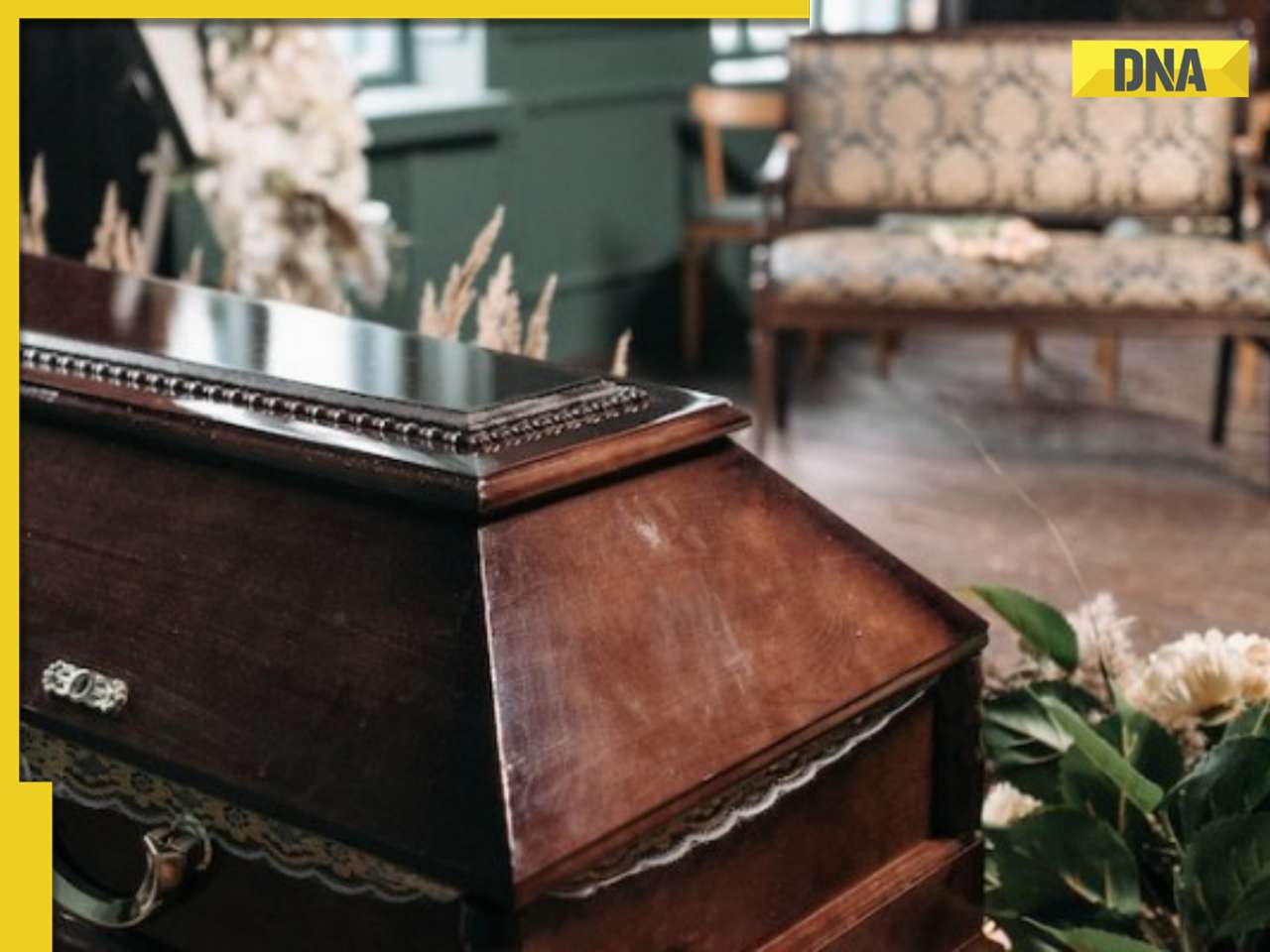

74-year-old woman found alive at funeral home after being pronounced dead![submenu-img]() This country with 96% Muslim population has banned Hijab, beard, prohibition on religious books too

This country with 96% Muslim population has banned Hijab, beard, prohibition on religious books too![submenu-img]() Viral video: Train passes through burning forest amid Russia's wildfires, watch

Viral video: Train passes through burning forest amid Russia's wildfires, watch

)

)

)

)

)

)

)